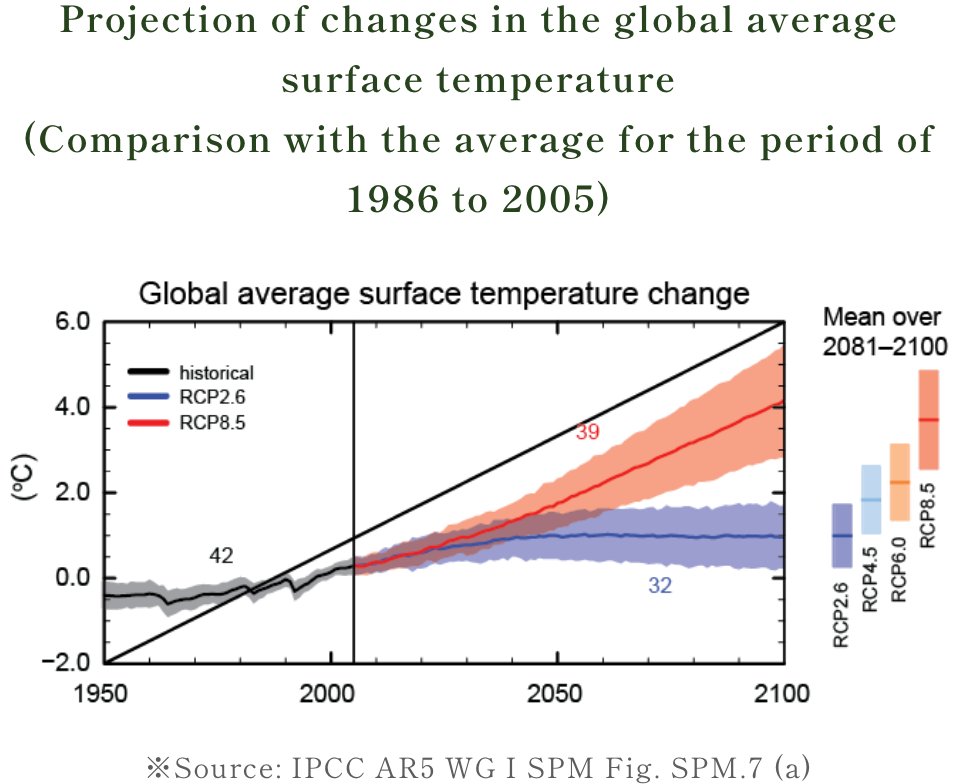

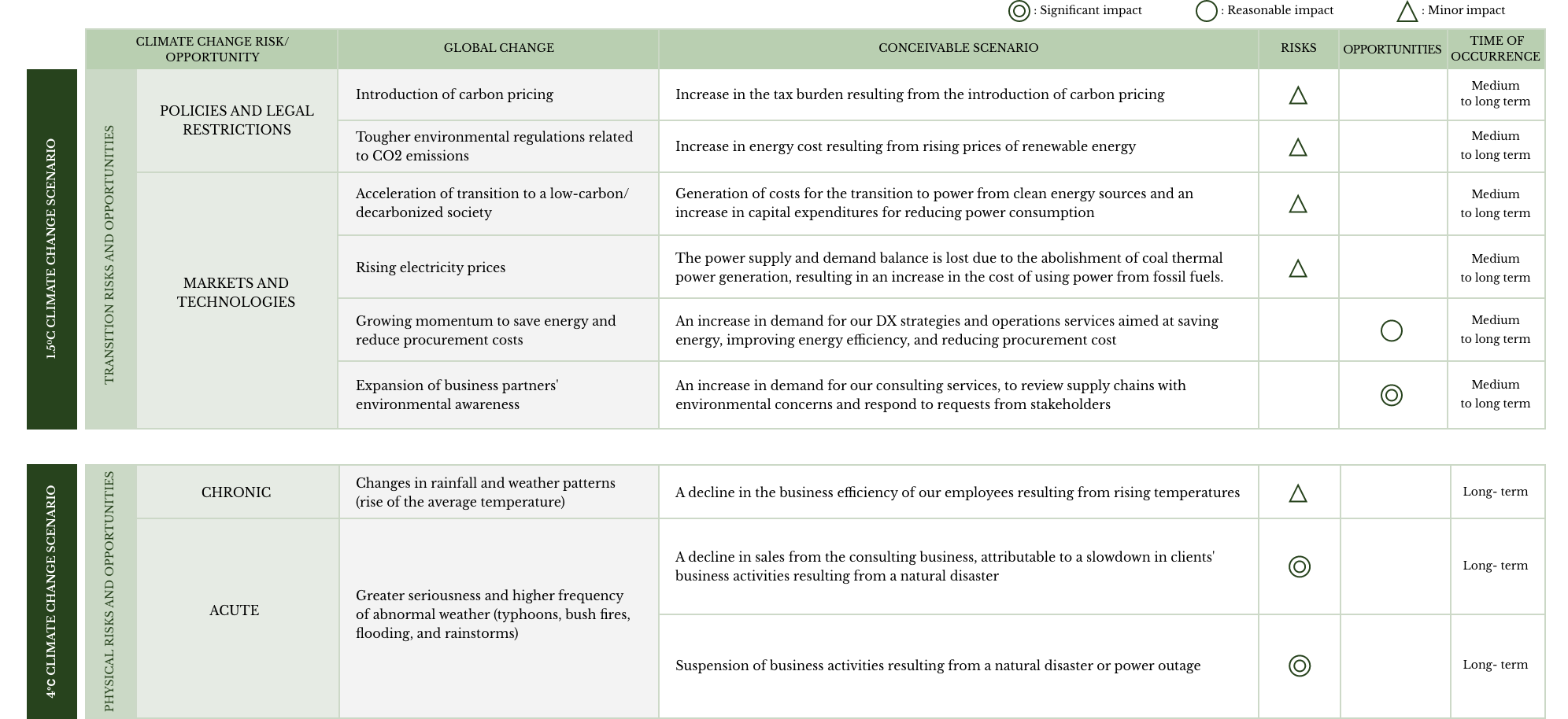

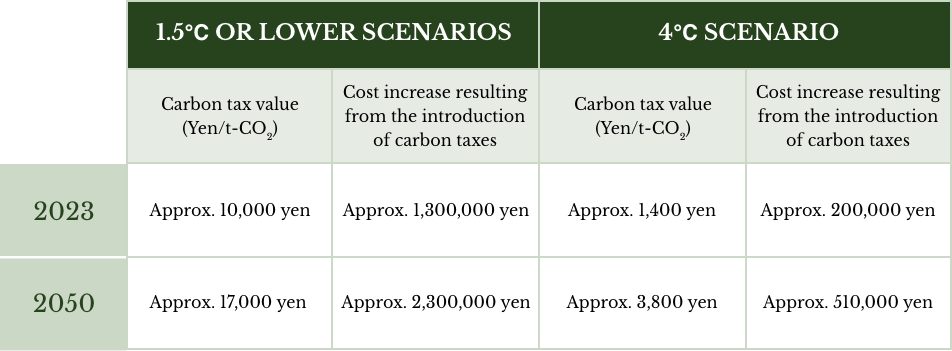

【1.5°C scenario *1】

In this scenario, rigorous measures are taken to address climate change and the temperature increase is limited to around 1.5°C above pre-industrial levels as of 2100.

Measures to address climate change are strengthened, and transition risks increase regarding political regulation, markets, technology, reputation, and other matters.

- *1

- As the parameters for estimating impact, the RCP2.6 scenario was used referencing information from the Intergovernmental Panel on Climate Change (IPCC) and the International Energy Agency (IAE).

【4°C scenario *2】

In this scenario, rigorous measures are not taken to address climate change, and the temperature has increased to around 4°C above pre-industrial levels as of 2100.

This leads to greater physical risks, including risks related to serious natural disasters, sea level rise, and more frequent abnormal weather.

- *2

- As the parameters for estimating impact, the RCP8.5 scenario was used, referencing information from the Intergovernmental Panel on Climate Change (IPCC) and the International Energy Agency (IAE).