How Companies Should Respond to the Changes in Society Brought by Accelerating Embedded Finance

Almost Any Business Can Become a Financial Services Business

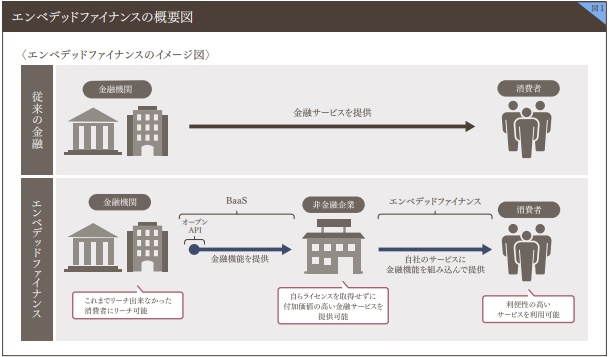

Embedded finance is a new form of service in which non-financial companies incorporate financial services into their own offerings.

It has been gaining attention in Japan since around 2020. End users can now use financial services in a seamless manner without having to go through a channel prepared by a financial institution. Non-financial companies benefit from increased service usage, while financial institutions enjoy indirect user acquisition. It is truly a win-win-win service (Figure 1).

Our client companies are not only continuing their existing B2C businesses but are also exploring banking and payment services such as direct debit and lending in the B2B2C market, and they are feeling the momentum behind embedded finance.

Embedded finance has become more widespread overseas than in Japan, and a general partner at the U.S. VC firm a16z has stated that "In the not-too-distant future, I believe nearly every company will derive a significant portion of its revenue from financial services."

From Canada...

To read the full text, please download the PDF.

DownloadPDF(2.64 MB)