Opportunity to Enter the Forthcoming B2B Cashless Payments Market

Issues Facing the 1,000 Trillion Yen Market and Signs of Change

Japan is lagging behind other countries in the shift towards cashless payments. According to the Ministry of Economy, Trade and Industry, the B2C cashless payment rate was 32.5% in 2021, reaching 36.0% in 2022. Of these transactions, more than half were made with credit cards, while the remainder were made with debit cards, electronic money, and code payments.

Although progress has been steady, the gap is evident compared to South Korea's 93.6%, China's 83.0%, the UK's 63.9%, and the US's 55.8%. (Source: "Cashless Roadmap 2022," published in June 2022 by the Cashless Promotion Council) This delay in cashless adoption is also evident in B2B payments.

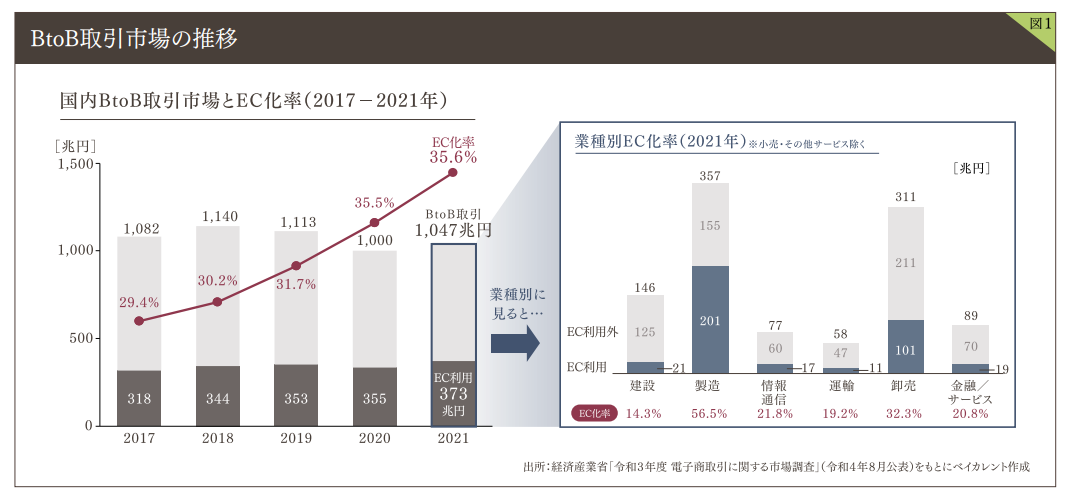

In 2021, the domestic market size for B2B transactions was approximately 1,000 trillion yen, and it did not decline significantly even during the COVID-19 pandemic. Payment methods for business-to-business transactions include bank transfers, direct debits, bills, checks, cash, and cashless payments such as credit cards, debit cards, and electronic money.

However, government statistics do not provide detailed information on the B2B cashless payment rate, which is the main topic of this article. The B2B payment market in Japan is substantial, estimated to be worth approximately 1,000 trillion yen. Despite this, the rate of cashless transactions is currently below 40%. As more companies begin to enter this attractive blue ocean market, the key to success will be to offer value beyond mere payment functions. This article will explore how to identify added value opportunities and implement services by examining pioneering companies overseas and successful examples in Japan. Additionally, the rate of digitalization, including EC usage (orders placed and received over the computer via the Internet, including transactions via EDI (Electronic Data Interchange)), is becoming clearer.

In 2021, the amount of EC usage was approximately 370 trillion yen, but the EC rate was only about 35%. In other words, about 65% of orders were still placed and received in writing, by telephone, fax, or other non-digital methods. In such non-EC transactions, payment is often made by non-cashless methods such as bank transfers. Additionally, not all EC transactions are cashless, as some EC transactions are paid by bank transfer. Therefore, even if the cashless payment rate for B2B transactions is estimated at the highest possible level, it would be roughly equivalent to the EC rate. Thus, the potential for cashless B2B payments can be seen as approximately 670 trillion yen.

For the spread of cashless B2B payments to take hold, the support of payment service providers such as card companies is essential. However, the reasons for the slow adoption lie not only with the payment service providers but also with each of the three parties involved: the party that issues the invoice (the biller) and the party that makes the payment (the payer).

■ Barriers and Challenges Preventing Cashless B2B Payments

Let's examine the barriers and challenges preventing the progress of cashless B2B payments from the perspectives of these three parties. ...

To read the full text, please download the PDF.

DownloadPDF(2.04 MB)