“BNPL”, a New Form of Deferred Payment, and the Future of Consumption and Payment

"BNPL": The Evolution of Deferred Payment

BNPL is an abbreviation for "Buy Now Pay Later." In other words, it means "buy now, pay later." It has been attracting attention in recent years as a "deferred payment service" that allows you to make instant EC payments without having to register a credit card in advance.

To begin with, deferred payment services are not particularly unusual. Catalog sales are an easy-to-understand example. You look at a booklet listing products, apply for a purchase, and when the product arrives later, an invoice is enclosed and you pay the price at a convenience store or by bank transfer. BNPL follows this payment process that is familiar to many people, but it differs from traditional catalog sales in that you view and order products online.

So how does BNPL differ from general online shopping? The biggest difference is that with BNPL, a credit card is not required. Purchases can be made without registering credit card information on the EC site, and payment is made at a later date by cash at a convenience store or bank transfer. The final payment is the same as with traditional catalog sales.

There are three main reasons why BNPL is currently attracting attention. The first is that due to the impact of COVID-19, people who used to shop at physical stores have started to stay at home and have shifted to using EC at home, embracing a "stay-at-home lifestyle". It is important to remember that the rapid expansion of the EC market is the root cause. The second is that there is no need for screening like with credit cards, so it is hassle-free, has low psychological costs, and has a low barrier to use. Generally, you only need to enter your phone number and email address. The third is that the consumer demographic that may have demand for BNPL has expanded and become apparent, including young people who cannot own credit cards, elderly people and women who avoid them, as well as people who want to survive the temporary loss of income caused by the COVID-19 pandemic. Combined with changes in social conditions, BNPL appealed to the target demographic that had been highlighted, accelerating market penetration.

BNPL System: The Essential Role of AI and Data

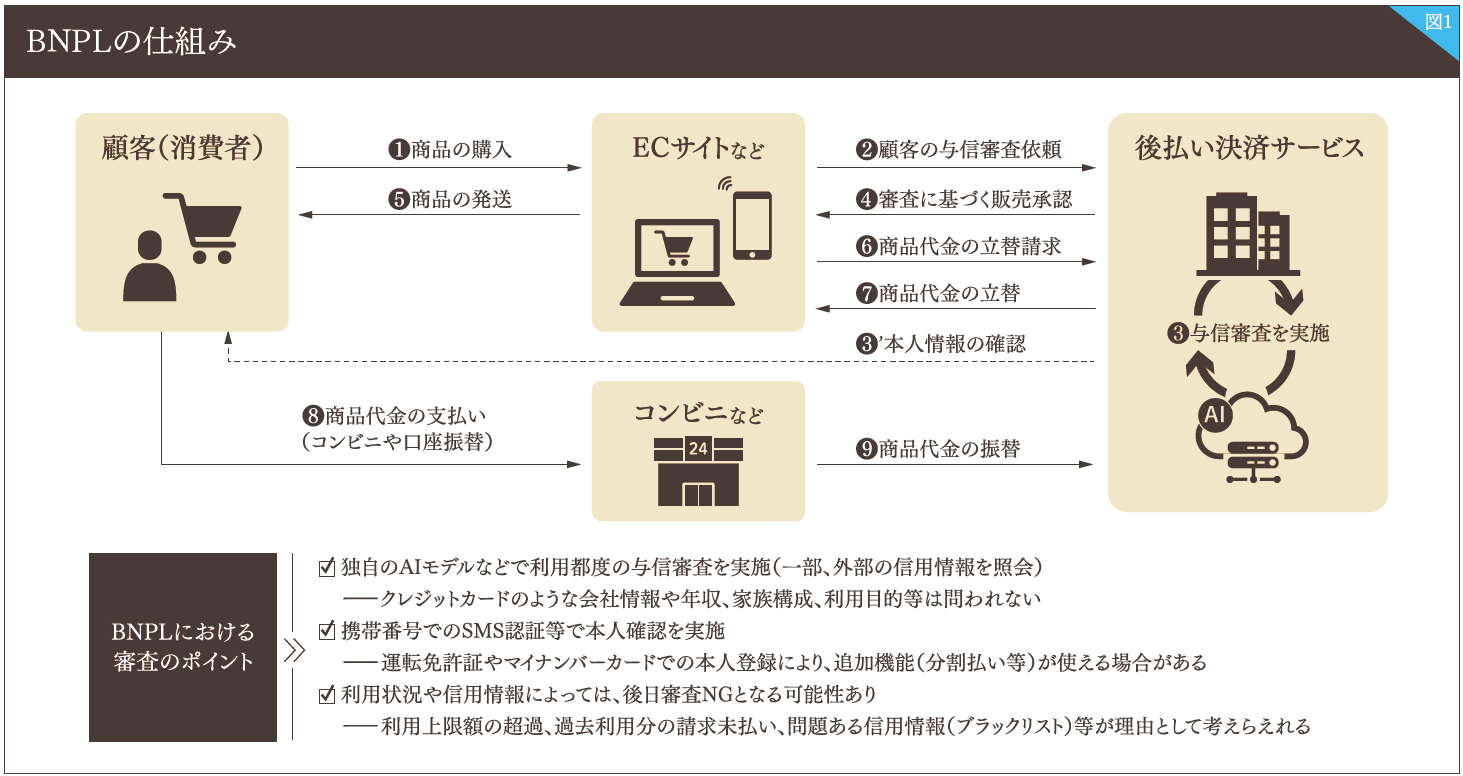

Figure 1 shows how BNPL works. First, a customer (consumer) selects a product on an EC site and places an order (❶). After receiving the order, the EC site requests a deferred payment service provider to verify the customer's creditworthiness (❷). The payment service provider then verifies the customer's identity by SMS authentication on the customer's mobile phone and conducts a credit check (❸). The important thing to note here is that, unlike credit cards, the customer's occupation, annual income, family structure, and purpose of use are not questioned. Except for some cases where the customer is registered on the so-called "blacklist" held by credit information agencies, the sale is approved (❹) and the product is shipped to the customer (❺). At this time, the deferred payment service provider receives a payment request from the EC site operator (❻) and pays the product price in advance (❼). At a later date, the customer pays the price at a convenience store or other location using the invoice or payment slip sent along with the product (❽), and the payment is transferred to the deferred payment service provider (❾).

Many postpaid payment companies provide their services through apps. For this reason, mobile phone numbers are often used for identity verification, but there are also services that offer special benefits for registering a driver's license or My Number card.

To read the full text, please download the PDF.

DownloadPDF(1.90 MB)